From footwear to grocery stores…

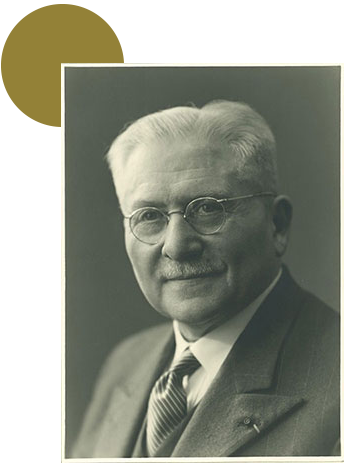

The adventure began in 1835 with Claude Gontard, who founded and then passed on to his son, François-Antoine Gontard, the “Manufacture de Chaussures Cousues et Rivées – Gontard Ainé & ses fils” established in Lyon. In 1909, François-Antoine’s two sons and partners, Albin and Louis Gontard, sold the company while ensuring the continuity of the name, which became “Chaussures Stéphane Gontard”.

Three years after its creation, in 1907, Albin and Louis acquired the Société des Docks Lyonnais. Under their impetus, the latter rapidly transformed into a “capitalist multi-branch food company”, expanding its network to 650 sales points in Rhône-Alpes and 3,000 across France. Strategic acquisitions, such as Société Laitière Moderne and Compagnie Générale des Vins du Midi et d’Algérie, further solidified its empire.

The supermarket and hypermarket revolution

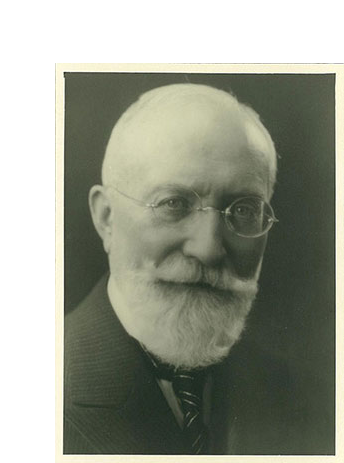

With the almost simultaneous passing of Louis and Albin in 1951, the group’s reins were entrusted to Albert Gontard, Albin’s eldest son. A visionary, Albert embraced the revolution of new American distribution systems by creating the GRO and Mini-GRO supermarket formats. He actively supported his son, Jacques Gontard, then President of Docks de Nevers, in developing the Carrefour franchise brand in the hypermarket format, drawing inspiration from the seminars of Bernardo Trujillo, the “pope” of distribution at the time.

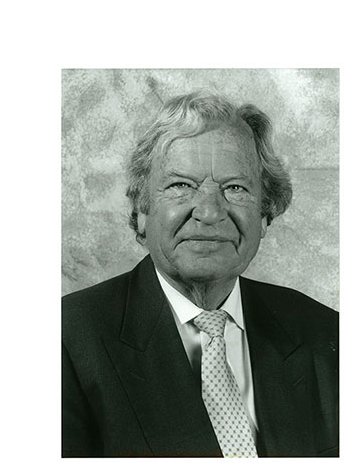

After a short period during which Jean Gontard, Albert’s brother, served as President, Jacques Gontard, his nephew and Albert’s son, succeeded him in 1975. Jacques further developed the mass retail sector, primarily hypermarkets under the Euromarché brand throughout France.

The Strategic shift towards Real Estate

The 1980s marked a major turning point: facing fierce competition and weakened profitability, acquisition proposals offered generous valuations for the businesses. In 1983, the small and medium-sized retail spaces were sold to Genty-Cathiard, which was integrated into Rallye, and in 1986, the Euromarché hypermarkets were sold to Carrefour.

As a consequence of this strategy, the Société des Docks Lyonnais transformed into a real estate and financial company. Its new purpose was to enhance its historical portfolio (notably the redevelopment of the former Vaise warehouses in Lyon’s 9th arrondissement) and to engage in new real estate operations in France, such as factory outlet stores.

Jacques Gontard

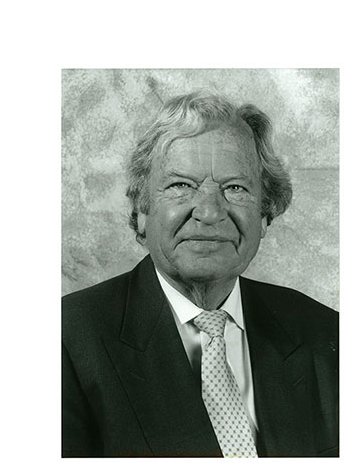

Yann Gontard

The new generation and the perpetuation of the legacy

In 1987 and 1989, Frédéric and Yann Gontard, Jacques’ sons, joined the Board of Directors. For nearly two decades, Yann Gontard contributed strategic vision and honed skills acquired within international companies specializing in Real Estate and finance.

At the end of 2005, with the advent of the tax regime for listed real estate investment companies (SIIC) leading to significant stock market valuations, the majority of Docks Lyonnais’ capital was sold to Shaftesbury Asset Management and the Continental European Fund (UBS Wealth Management), opening a new phase of development.

At this pivotal moment, Yann Gontard founded Groupe Gontard to perpetuate the evolution of the family’s history. He established a legal structure dedicated to Real Estate and financial services, as well as short-term and long-term investment vehicles based on the intrinsic quality of acquired assets. He thus built upon a multi-generational family tradition of entrepreneurship to sustain a group firmly focused on the future in the Real Estate and financial sectors, thereby paying lasting homage to the inherited legacy.